Thread: Interesting New Protocol + Farming(ish) Opportunity

..

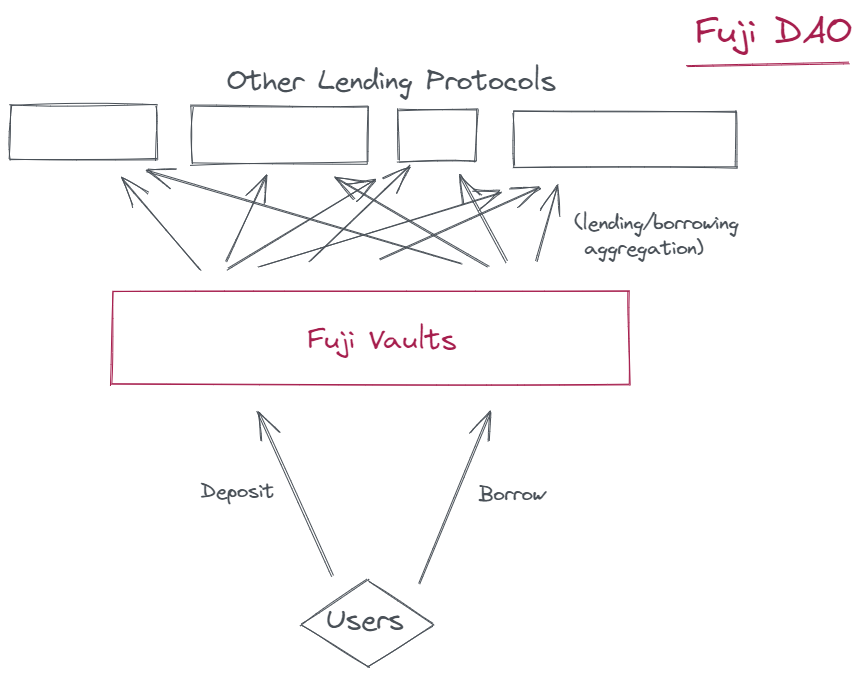

So, this thread is about Fuji Dao @FujiFinance, which is the first 'lending aggregator' in defi!

1/x

Essentially they allow lending and borrowing where deposits + borrows are aggregated through other lenders on the backend, to ensure users get the best possible rates.

Yield aggregators and dex (amm) aggregators are already common in defi, however…

2/x

…as far as I understand, @FujiFinance is the first lending aggregator to be developed.

Apparently the idea was born during ETHGlobal "MarketMake" hackathon in January 2021, which is where the founders met.

3/x

These founders include:

@BoyanBarakov

@DaigaroC

@TheEdgarMoreau

Here is a really good AMA they just did with the good @EthFugu:

https://www.youtube.com/watch?v=l5da_myRnLI

4/x

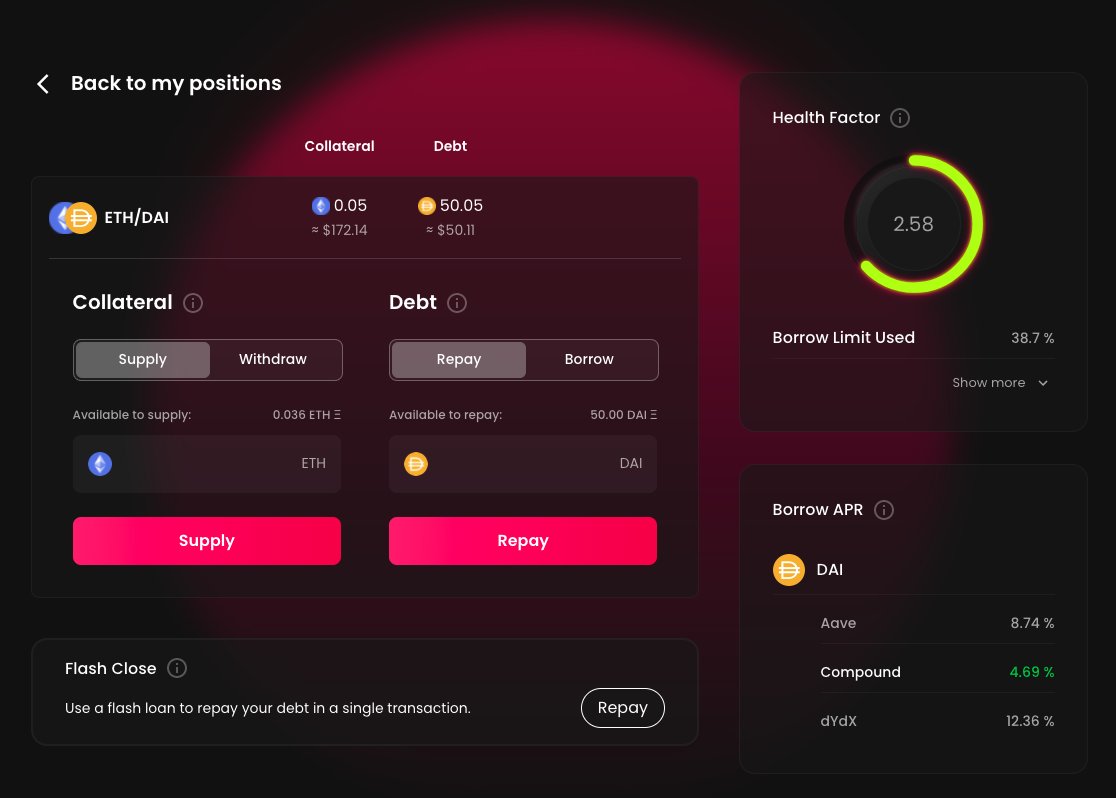

Utilizing @FujiFinance looks to be roughly the same as using other lending protocols, but with the added benefits of Fuji optimizing/aggregating on the backend, to ensure you get the lowest costs on borrowing (with maximization of deposit yields also coming in future).

5/x

As of right now they are on ETH L1 and on Fantom.

The Fantom expansion is the one of most relevance to this thread, because the @FujiFinance team has launched the "Fuji Climb: Fantom Expedition", where new users can earn future Fuji tokens 🙂

https://twitter.com/FujiFinance/status/1532053251415330816

6/x

The Fuji Climb Expedition is a gamified contest to reward users.

The more you borrow, the more Meter Points/Climbing Score you will earn, which can then be used to qualify for pre-token bonds!

There's also going to be NFT's/etc built into the gamification.

7/x

I like the team's use of pre-token bonds in this way, and on the AMA they talk about wanting to be very purposeful about the Fuji token, so it doesn’t just end up being a typical high-emissions, rise-fast-then-fall trajectory, like with many lending protocols and AMM tokens.

8/x

Getting back to the mechanics of the protocol, they are so far integrated with several lending platforms on ETH L1, and currently on Fantom they are integrated with Geist, Iron Bank, and Hundred Finance, with an integration of Aave V3 to be added very soon.

9/x

Right now you can borrow $DAI or $USDC against $FTM, $ETH, or $BTC, but again, on this front too more tokens will likely be added in the future.

FujiDao generates protocol revenue by charging 0.2% above the lowest borrowing rate (akin to what yield/dex aggregators do).

10/x

The protocol uses alot of interesting tech like flashloans/etc to handle the aggregation/mechanics, but it is frankly a bit over my head so would recommend checking out their docs or the AMA, where they discuss it 🙂

They have had audits from Securing and Trail Of Bits.

11/x

To get started using the protocol, click the link in their Twitter profile below:

https://twitter.com/FujiFinance

12/x

If you want to get involved with the protocol, you can also check out their Discord at the following link:

https://discord.com/invite/XN96n63xUW

13/x

For more good info on them, check out this excellent thread by Mr @DeFi_Made_Here:

https://twitter.com/DeFi_Made_Here/status/1532366592880910337

14/x

And remember, the Fuji Climb expedition thing is going on right now, so if you're interested in qualifying for the pre-token bonds, make sure to check it out!

https://twitter.com/FujiFinance/status/1532417673128288257

15/x

Note: I do not have any affiliation with the FujiDao team, though I'll likely try it out to qualify for the pre-token bonds 🙂

This thread was made in concert with @CRE8RDAO.

I am a dumb ape and as always all my threads are NFA!

16/x

Tagging some Chads for the culture:

@phtevenstrong

@Prof_Crypto_B

@crypto_klay

@b05crypto

@Dynamo_Patrick

@FinFreeWizard

@MrWinstonWolf_

@zerototom

@Mark2work

@Riley_gmi

@CompleteDegen

17/x

Also: Here is an awesome thread on @FujiFinance from the gents at @The_ReadingApe:

https://twitter.com/The_ReadingApe/status/1533840921686470657

18/x

And a fantastic video on @FujiFinance from my friend @Ceazor7:

https://www.youtube.com/watch?v=0VQ_fcWeLHk

19/x

Originally tweeted by rektdiomedes (@rektdiomedes) on June 8, 2022.